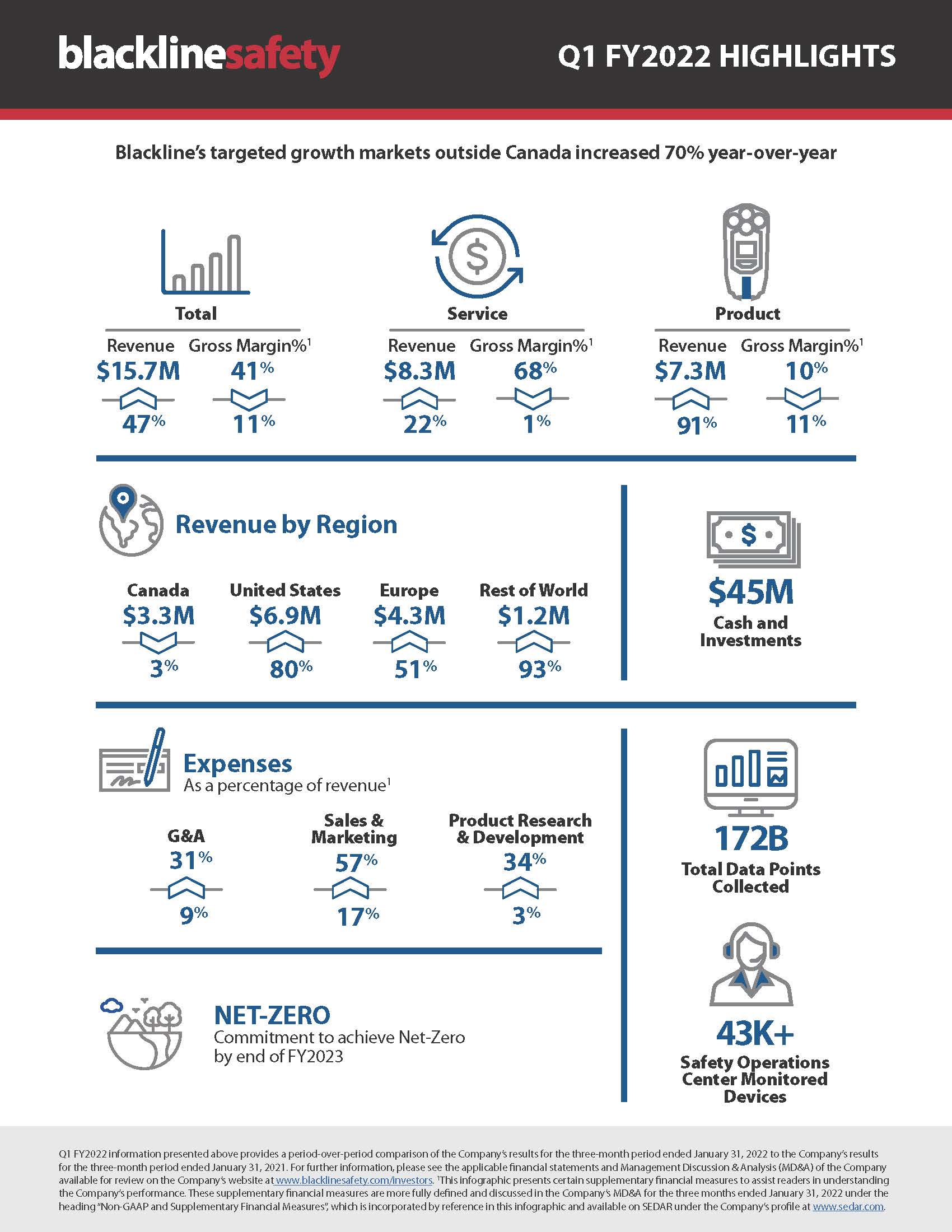

Blackline Safety Reports Fiscal First Quarter of 2022 Revenue Up 47% Year-over-Year to $15.7 Million

Blackline Safety, Leader in Connected Gas Detection & Lone Worker Safety

March 16, 2022

20th consecutive quarter of year-over-year quarterly revenue growth

Calgary, Canada —March 16, 2022 — Blackline Safety Corp. (TSX: BLN), a global leader in connected safety technology, today reported record fiscal first quarter financial results for the period ended January 31, 2022.

- 20th consecutive quarter of year-over-year quarterly revenue growth

- Sales outside North America and Europe grew 93% year-over-year

- Recurring software services revenue up 25% year-over-year

Management Commentary

“Blackline’s strong revenue growth during the quarter is further evidence of the benefits from our ‘Invest to Grow’ strategy,” said Cody Slater, CEO and Chair of Blackline Safety. “Our expanded sales team continued to make strides, especially in our United States and Rest of World (outside of North America and Europe) segments with 80% and 93% total revenue growth, respectively. While Europe’s sales grew 51% year-over-year in the quarter, we expect the region’s growth rates to accelerate in the remainder of fiscal 2022.

“Our customer net dollar retention(1) remained strong at 103% in the quarter. Continuing growth in our software services revenue, demonstrates the stickiness of our hardware-enabled software-as-a-service (HeSaaS) business model. In fact, every $1 generated in G7 wearable sales translates to approximately $4 in lifetime recurring service revenue, illustrating the attractiveness and efficiency of our HeSaaS model.”

“While global supply chain constraints are presenting some challenges and elevated costs in the near-term, I am proud of our team’s success mitigating these challenges and delivering for our customers, where we continue to see extremely healthy demand for our products and services. We are adapting where we can to recapture our hardware margins but, ultimately, this is a short-term challenge that does not affect the higher margin profitability of our multiyear service revenue from our customers. In addition, we have successfully scaled our operations to capitalize on our future growth opportunities in our current industrial markets, as well as new types of workplaces as we transform them through connected worker technology.”

Fiscal First Quarter 2022 Financial and Operational Highlights

- 20th consecutive quarter of year-over-year quarterly revenue growth

- Total revenue of $15.7 million, a 47% increase over the prior year’s Q1

- Total revenue grew by 80% in the United States (“U.S.”), 51% in Europe and 93% in Rest of World markets compared to the prior year’s Q1

- Product revenue of $7.3 million, a 91% increase from the prior year’s Q1

- Service revenue of $8.3 million, a 22% increase over the prior year’s Q1, comprised of:

- Software services revenue of $7.4 million, a 25% increase from the prior year’s Q1

- Operating lease revenue of $0.7 million, a 15% decrease from the prior year’s Q1

- Rental revenue of $0.2 million, a 188% increase from the prior year’s Q1

- Secured a $4.3 million contract with a new major U.S. energy customer

- Presented connected worker innovations as a featured exhibitor at ADIPEC Exhibition in Abu Dhabi

- Recognized on Deloitte’s Enterprise Fast 15 as the 9th fastest growing enterprise company in Canada with 230% revenue growth over the last three years

- Named as a preferred vendor for Shell plc. in a three-year global framework agreement to supply connected worker solutions enterprise-wide

- Closed previously announced agreement to open a facility in Dubai, UAE in response to customer demand in the region

Annual Recurring Revenue(1) gains momentum, 11% sequential improvement versus the prior quarter

Product sales through the last twelve months, along with robust retention and renewal activity, fuelled an increase of 25% in software services revenue during the first quarter for 2022 compared to the prior year quarter. Software services revenue grew 9% compared with the fourth quarter of 2021 due to increasing deployments for significant contracts won in the second half of FY2021. Total service revenue for the quarter was $8.3 million up 22% from $6.8 million in the prior year quarter. We exited the first quarter with Annual Recurring Revenue(1) of $33.2 million, representing 11% growth from the prior quarter.

Service gross margin percentage(1) remained strong at 68% in the first quarter and in line with the prior year quarter. Product gross margin percentage(1) was negatively impacted by ongoing global supply chain challenges resulting in higher than normal component costs and freight charges. Product margins were also affected by lower unabsorbed material and labour costs and product mix between the G7 and G7 EXO product lines.

At quarter end, Blackline had cash and short-term investments of $45.0 million and no debt. The Company’s cash position enabled it to invest in its manufacturing infrastructure and support the working capital required to maintain flexibility in the face of ongoing challenges in the global supply chain. During the quarter, the Company expanded its production line capacity with $0.6 million of Surface Mount Technology and manufacturing equipment brought online. Additionally, the recent investment in Blackline Safety’s rental fleet has allowed the Company to respond to early demand for its full suite of connected devices where capacity has been expanded to 1,500 hardware units since launching the program in spring of 2021.

“We are excited to launch the first-of-its-kind G6 connected personal safety device for the zero-maintenance market in July 2022 and the G5 in the light industry and construction market in early fiscal 2023,” added Slater. “Both launches build on our success with the G7 and G7 EXO and will extend Blackline’s competitive lead with the most comprehensive connected safety suite of technologies globally, including our Blackline Live portal for cloud-based real-time reporting.

“Our team continually strives to innovate new ways to connect all elements of the industrial worksite more broadly in order to further enhance workplace safety and operational efficiency. Our investment in sales and technology infrastructure over the past two years has established the foundation to not only take the connected G6 into the zero-maintenance market of over two million unconnected devices, but also expand beyond gas detection and begin to connect the broader industrial workplace. With the G5, we will be targeting new areas where we currently have little to no penetration, significantly increasing our total addressable market.”

(1) This news release presents certain non-GAAP and supplementary financial measures, including key performance indicators used by management and typically used by companies in the software-as-a-service industry, as well as non-GAAP ratios to assist readers in understanding the Company’s performance. Further details on these measures and ratios are included in the “Key Performance Indicators,” and “Non-GAAP and Supplementary Financial Measures” sections of this news release.

Financial Highlights

The subsequent values in this news release are in CAD millions, except for percentages and per share data.

|

|

Three-months ended January 31 |

||

|

|

2022 |

2021 |

Change |

|

|

$ |

$ |

% |

| Revenue |

15.7 |

10.7 |

47 |

| Gross margin |

6.4 | 5.6 |

15 |

| Gross margin percentage(1) |

41% |

52% |

(11) |

| Net loss |

(12.9) |

(4.9) |

164 |

| Loss per common share |

(0.21) |

(0.09) |

133 |

| EBITDA(1) |

(11.4) |

(3.9) |

(196) |

| EBITDA per common share(1) |

(0.19) |

(0.07) |

(171) |

| Adjusted EBITDA(1) |

(6.4) |

(0.4) |

(1,674) |

| Adjusted EBITDA per common share(1) |

(0.11) |

(0.01) |

(1,000) |

(1) This press release presents certain non-GAAP and supplementary financial measures, as well as non-GAAP ratios to assist readers in understanding the Company’s performance. Further details on these measures and ratios are included in the “Non-GAAP and Supplementary Financial Measures” section of this press release.

Key Financial Information

First quarter revenue was $15.7 million an increase of 47% from $10.7 million in the comparable quarter of the prior fiscal year, with the U.S. up 80% and Rest of World revenues up 93% being the largest geographic growth regions quarter-over-quarter.

Service revenue during the first quarter was $8.3 million, an increase of 22% compared to $6.8 million in the same quarter last year. Retention rates of our existing customers across geographic regions and industry sectors remained robust. Service revenue increases within our existing customer base contributed $0.5 million during the quarter. There were also adverse effects of $0.3 million from customers who renewed fewer active devices after experiencing workforce reductions during the last twelve months. In addition, certain customers declined to renew their service plans resulting in negligible reductions.

Service revenue for the quarter was positively impacted by the strong growth of 188% in rental revenue compared to the prior year quarter due to the application of the Company’s complete suite of connected worker and area monitoring solutions in the industrial turnaround and maintenance market. Product revenue during the first quarter was $7.3 million, an increase of 91% compared to $3.8 million in the prior year quarter, as we saw the return to more normal procurement processes, particularly in the U.S. and Rest of World markets and continued sales of our new G7 EXO area gas monitors during the quarter. The increase also reflects the Company’s investment in its expanded sales network across North America, the European Union and other geographies over the last twelve months.

Overall gross margin percentage for the first quarter was 41%, an 11% decrease compared to the prior year quarter driven by a heavier product versus service mix. Service gross margin percentage was 68% in the first quarter due to higher overall service volumes, partially offset by higher carrier costs for the connectivity of the Company’s devices as well as increases in personnel costs for Safety Operations Centre team members and the product development support team. Product gross margin percentage decreased to 10% from 21% in the prior year quarter due to higher material, supply and freight costs resulting from global supply chain challenges. Warranty and scrappage costs were also higher in the quarter.

Net loss and EBITDA were $12.9 million and ($11.4) million respectively in the first quarter, driven by an 84% increase in total expenses as the Company executed its ‘Invest to Grow’ strategy. The increase in the net loss for the quarter was attributable to an increase in general and administrative, sales and marketing expenses, and product research and development costs, primarily as a result of higher salaries expense from additional new hires.

Adjusted EBITDA was ($6.4) million for the first quarter compared to ($0.4) million in the prior year quarter. The decline in adjusted EBITDA in the quarter was primarily attributable to the investments made to grow the business which resulted in an increase in general and administrative and selling and marketing expenses including higher salaries from additional team members.

Blackline’s interim condensed consolidated financial statements and management’s discussion and analysis on financial condition and results of operations for the three-months ended January 31, 2022 are available on SEDAR under the Company’s profile at www.sedar.com. All results are reported in Canadian dollars.

Conference Call

A conference call and live webcast have been scheduled for 11:00 am ET on Wednesday, March 16, 2022. Participants should dial 1-800-319-4610 or +1-416-915-3239 at least 10 minutes prior to the conference time. A live webcast will also be available at https://www.gowebcasting.com/11756. Participants should join the webcast at least 10 minutes prior to the conference time to register and install any necessary software. If you cannot make the call live, a replay will be available within 24 hours by dialing in to either of the phone numbers above and entering replaying access code 8635.

Blackline Safety is a global connected safety leader that helps to ensure every worker gets their job done and returns home safely each day. Blackline provides wearable safety technology, personal and area gas monitoring, cloud-connected software and data analytics to meet demanding safety challenges and increase productivity of organizations with coverage in more than 100 countries. Blackline Safety wearables provide a lifeline to tens of thousands of men and women, having reported over 172 billion data-points and initiated over five million emergency responses. Armed with cellular and satellite connectivity, we ensure that help is never too far away. For more information, visit BlacklineSafety.com and connect with us on Facebook, Twitter, LinkedIn and Instagram.

###

INVESTOR/ANALYST CONTACT

Cody Slater, CEO

Telephone: +1 403 451 0327

MEDIA CONTACT

Christine Gillies, CMO

Telephone: +1 403 629 9434

Non-GAAP and Supplementary Financial Measures

This press release presents certain non-GAAP and supplementary financial measures, including key performance indicators used by management typically used by our competitors in the software-as-a-service industry, as well as non-GAAP ratios to assist readers in understanding the Company’s performance. These measures do not have any standardized meaning and therefore are unlikely to be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Management uses these non-GAAP and supplementary financial measures, as well as non-GAAP ratios and key performance indicators to analyze and evaluate operating performance. Blackline also believes the non-GAAP and supplementary financial measures defined below are commonly used by the investment community for valuation purposes, and are useful complementary measures of profitability, and provide metrics useful in Blackline’s industry.

Throughout this news release, the following terms are used, which do not have a standardized meaning under GAAP.

Key Performance Indicators

The Company recognizes service revenues ratably over the term of the service period under the provisions of agreements with customers. The terms of agreements, combined with high customer retention rates, provides the Company with a significant degree of visibility into near-term revenues. Management uses a number of metrics, including the ones identified below, to measure the Company’s performance and customer trends, which are used to prepare financial plans and shape future strategy. Key performance indicators may be calculated in a manner different than similar key performance indicators used by other companies.

- “Net dollar retention” compares the aggregate service revenue contractually committed for a full period under all customer agreements of our total customer base as of the beginning of each period to the total service revenue of the same group at the end of the period. It includes the effect of our service revenue that expand, renew, contract or attrit, but excludes the total service revenue from new activations during the period.

- “Annual recurring revenue” is the total annualized value of recurring service amounts (ultimately recognized as software services revenue) of all service contracts at a point in time. Annualized service amounts are determined solely by reference to the underlying contracts, normalizing for the varying revenue recognition treatments under IFRS 15. It excludes one-time fees, such as for non-recurring professional services, and assumes that customers will renew the contractual commitments on a periodic basis as those commitments come up for renewal, unless such renewal is known to be unlikely.

Non-GAAP Financial Measures

A non-GAAP financial measure: (a) depicts the historical or expected future financial performance, financial position or cash of the Company; (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most comparable financial measure presented in the primary consolidated financial statements; (c) is not presented in the primary financial statements of the Company; and (d) is not a ratio.

Non-GAAP financial measures presented and discussed in this news release are as follows:

“EBITDA” is useful to securities analysts, investors and other interested parties in evaluating operating performance by presenting the results of the Company on a basis which excludes the impact of certain non-operational items. EBITDA refers to earnings before interest expense, interest income, income taxes, depreciation and amortization.

“Adjusted EBITDA” is useful to securities analysts, investors and other interested parties in evaluating operating performance by presenting the results of the Company on a basis which excludes the impact of certain non-operational items, product research and development costs related to new and existing products, which enables the primary readers of the news release to evaluate the results of the Company such that it was operating without any expenditures in product research and development, and certain non-cash and non-recurring items, such as stock compensation expense, that the Company considers appropriate to adjust given the irregular nature and relevance to comparable companies. Adjusted EBITDA is calculated as earnings before interest expense, interest income, income taxes, depreciation and amortization, stock-based compensation expense, product development costs and non-recurring impact transactions, if any. The Company considers an item to be non-recurring when a similar revenue, expense, loss or gain is not reasonably likely to occur within the next two years or has not occurred during the prior two years.

| Reconciliation of non-GAAP |

Three-months ended January 31, |

||

| CAD millions |

2022 |

2021 |

Change |

| $ |

$ |

% |

|

| Net loss |

(12.9) |

(4.9) |

164 |

| Depreciation and amortization |

1.6 |

1.1 |

37 |

| Finance income, net |

(0.1) |

(0.1) |

(9) |

| Income tax |

- |

- |

(100) |

| EBITDA |

(11.4) |

(3.9) |

(196) |

| Product research and development costs, net of depreciation, amortization and stock-based compensation expense(1) |

5.0 |

3.2 |

58 |

| Stock-based compensation expense(2) |

- |

0.3 |

(83) |

| Adjusted EBITDA |

(6.4) |

(0.4) |

(1,674) |

- Product research and development costs exclude depreciation and amortization, as well as stock-based compensation relating to product research and development is excluded and adjusted in the subsequent line as defined below.

- Stock-based compensation expense relates to the Company’s stock compensation plan and stock option expense extracted from cost of sales, general and administrative expenses, sales and marketing expenses and product research and development costs on the consolidated statements of loss and comprehensive loss.

Non-GAAP Ratios

A non-GAAP ratio is a financial measure presented in the form of a ratio, fraction, percentage or similar representation and that has a non-GAAP financial measure as one or more of its components.

Non-GAAP ratios presented and discussed in this news release is follows:

“EBITDA per common share” is useful to securities analysts, investors and other interested parties in evaluating operating and financial performance. EBITDA per common share is calculated on the same basis as net loss per common share, utilizing the basic and diluted weighted average number of common shares outstanding during the periods presented.

“Adjusted EBITDA per common share” is useful to securities analysts, investors and other interested parties in evaluating operating and financial performance. Adjusted EBITDA per common share is calculated on the same basis as net income (loss) per common share, utilizing the basic and diluted weighted average number of common shares outstanding during the periods presented.

Supplementary Financial Measures

A supplementary financial measure: (a) is, or is intended to be, disclosed on a periodic basis to depict the historical or expected future financial performance, financial position or cash flow of the Company; (b) is not presented in the financial statements of the Company; (c) is not a non-GAAP financial measure; and (d) is not a non-GAAP ratio.

Supplementary financial measures presented and discussed in this news release is as follows:

- “Gross margin percentage” represents gross margin as a percentage of revenue

- “Product gross margin percentage” represents product gross margin as a percentage of product revenue

- “Service gross margin percentage” represents service gross margin as a percentage of service revenue

Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively "forward-looking information") within the meaning of applicable securities laws relating to, among other things, Blackline Safety's expectation to realize potential from its intended investment in organic growth opportunities in 2022, that Blackline intends to continue to maintain capital flexibility to maintain its growth strategies and investments in sales and marketing with an expanded sales network and new digital lead generation capabilities, expectations with respect to continuing to accelerate product commercialization, including the launch of the first of its kind G6 connected personal safety device for the zero-maintenance market in July 2022, as well as the early fiscal 2023 initial product launch of the G5, the next generation of Blackline Live for cloud-based real-time reporting, Blackline’s ability to extend its competitive lead with the most comprehensive connected safety suite of technologies in the world. Blackline provided such forward-looking statements in reliance on certain expectations and assumptions that it believes are reasonable at the time, including expectations and assumptions concerning business prospects and opportunities, customer demands, the availability and cost of financing, labor and services, that Blackline will pursue growth strategies and opportunities in the manner described herein, and that it will have sufficient resources and opportunities for the same, or that other strategies or opportunities may be pursued in the future, and the impact of increasing competition. Although Blackline believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Blackline can give no assurance that they will prove to be correct. Forward-looking information addresses future events and conditions, which by their very nature involve inherent risks and uncertainties, including the risks discussed in Blackline's Management's Discussion and Analysis and annual information form for the year ended October 31, 2021 and available on SEDAR at www.sedar.com. Blackline's actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Blackline will derive therefrom. Management has included the above summary of assumptions and risks related to forward-looking information provided in this press release in order to provide readers with a more complete perspective on Blackline's future operations and such information may not be appropriate for other purposes. Readers are cautioned that the foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this press release and Blackline disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.